Chase CD, or Chase Certificates of Deposit, are financial products offered by JPMorgan Chase that allow you to invest money for a fixed period while earning a higher interest rate compared to regular savings accounts. These financial instruments are designed for individuals looking for a secure way to save money and earn interest over time. In this article, we will delve into the details of Chase CDs, exploring their benefits, types, interest rates, and how they compare to other investment options.

Certificates of Deposit are considered low-risk investments, making them appealing for individuals who prefer stability over high risk. Understanding how Chase CDs work, the requirements for opening an account, and the potential returns is essential for making informed financial decisions. We will also cover important concepts such as early withdrawal penalties and how to choose the right CD for your financial goals.

By the end of this article, you will have a thorough understanding of Chase CDs and be equipped with the knowledge to make the best investment choice for your future. Let’s get started!

Table of Contents

- What is Chase CD?

- Types of Chase CDs

- Chase CD Interest Rates

- Benefits of Chase CDs

- Requirements for Opening a Chase CD

- Early Withdrawal Penalties

- Chase CD vs. Other Investment Options

- Conclusion

What is Chase CD?

A Chase Certificate of Deposit (CD) is a savings product that allows you to deposit a lump sum of money for a predetermined period, which can range from a few months to several years. In return, you earn interest on your deposit at a fixed rate. The main appeal of Chase CDs is the guaranteed return on investment, making them an excellent choice for conservative savers.

How Do Chase CDs Work?

When you open a Chase CD, you agree to leave your money untouched for the duration of the term. In exchange, Chase will pay you interest at a rate that is higher than standard savings accounts. Upon maturity, you can withdraw your initial deposit along with the accrued interest. If you need access to your funds before the term ends, you may incur an early withdrawal penalty.

Types of Chase CDs

Chase offers several types of CDs to cater to different savings goals and preferences. Here are the most common types:

- Standard CD: A traditional CD with fixed terms and interest rates.

- Jumbo CD: Requires a higher minimum deposit but often offers higher interest rates.

- Special CDs: Limited-time offers that provide competitive rates for specific terms.

Choosing the Right Type of CD

When selecting a type of CD, consider your financial goals, how long you can commit to leaving your money untouched, and the minimum deposit requirements. Assessing your needs will help you choose the best option for your situation.

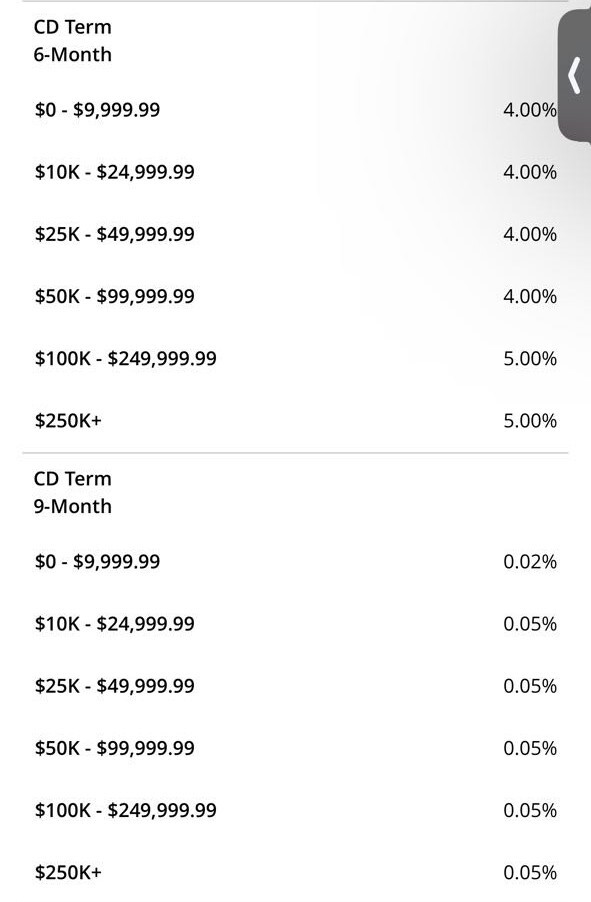

Chase CD Interest Rates

Chase CD interest rates vary based on the type of CD, the term length, and market conditions. Generally, longer terms yield higher interest rates. It is essential to shop around and compare rates to ensure you get the best return on your investment.

Current Rates and Comparisons

As of now, Chase offers competitive rates for their CDs. Here’s a quick overview:

- 3-Month CD: X% APY

- 6-Month CD: Y% APY

- 12-Month CD: Z% APY

- 24-Month CD: A% APY

These rates are subject to change, so it’s advisable to check Chase’s official website for the most current rates.

Benefits of Chase CDs

Chase CDs come with several advantages that make them an attractive savings option:

- Guaranteed Returns: Fixed interest rates ensure predictable earnings.

- Low Risk: CDs are generally considered safe investments.

- FDIC Insurance: Deposits are insured up to $250,000 per depositor.

- Flexible Terms: Various term lengths allow you to choose what fits your needs.

Building a Savings Strategy

Incorporating Chase CDs into your savings strategy can help you achieve specific financial goals, such as saving for a home or funding education. It’s essential to evaluate your overall financial situation and consider how CDs fit into your broader investment portfolio.

Requirements for Opening a Chase CD

To open a Chase CD, you need to meet certain requirements:

- Minimum deposit amount (varies by CD type)

- Valid government-issued ID

- Social Security number or Tax Identification Number

You can open a Chase CD online, in-person at a branch, or over the phone. Ensure you have the necessary documentation ready to streamline the process.

Early Withdrawal Penalties

One of the key aspects of Chase CDs is the penalty for withdrawing funds before the maturity date. Early withdrawal penalties can include:

- For terms of less than 1 year: 90 days of interest

- For terms of 1 year or more: 180 days of interest

Understanding these penalties is crucial to avoid unexpected losses, so consider your cash flow needs before investing in a CD.

Chase CD vs. Other Investment Options

When considering where to invest your money, it’s essential to compare Chase CDs with other options, such as savings accounts, money market accounts, and stocks.

Chase CD vs. Savings Accounts

While both offer low-risk options, Chase CDs typically provide higher interest rates than traditional savings accounts, making them a better choice for long-term savings.

Chase CD vs. Stocks

Investing in stocks can yield higher returns but comes with increased risk. CDs are ideal for those who prefer guaranteed returns and lower risk exposure.

Conclusion

Chase CDs are a secure way to save and earn interest on your money. With various types available, competitive interest rates, and the assurance of FDIC insurance, they are an excellent choice for conservative investors. Before making any investment, consider your financial goals, term preferences, and potential penalties for early withdrawal. If you’re looking for a stable investment, a Chase CD might be the perfect fit for you.

We invite you to share your thoughts in the comments below, and don’t forget to check out our other articles for more financial tips and insights!

Penutup

Thank you for reading our comprehensive guide on Chase CDs. We hope you found the information useful and encourage you to visit our site again for the latest updates and tips on financial planning.